Before investing, investors should carefully consider the investment objectives, risks, charges, and expenses of the variable annuity and its underlying investment options. The current contract prospectus and underlying fund prospectuses provide this and other important information. Please contact your Jackson representative or the Company to obtain the prospectuses. Please read the prospectuses carefully before investing or sending money.

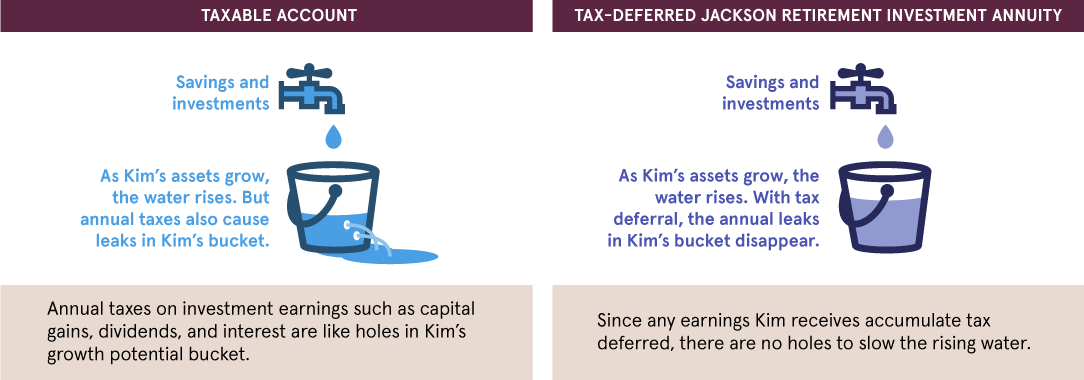

Jackson, its distributors, and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Tax laws are complicated and subject to change. Tax results may depend on each taxpayer's individual set of facts and circumstances. Clients should rely on their own independent advisors as to any tax, accounting, or legal statements made herein.

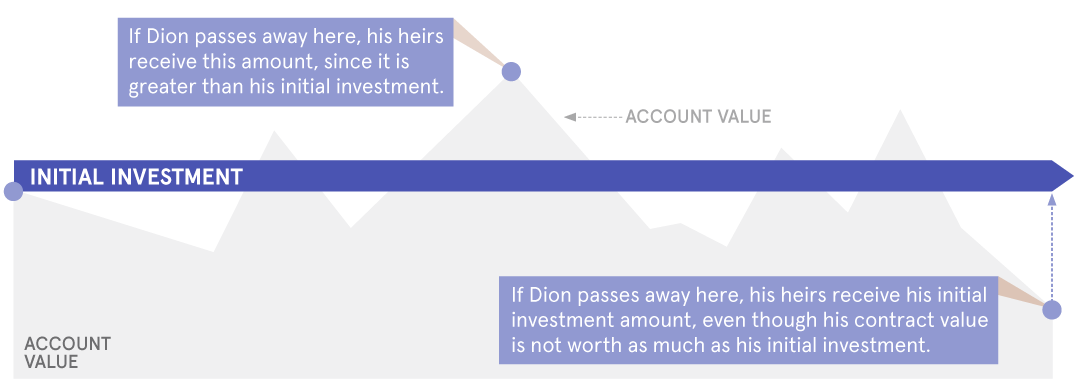

Guarantees are backed by the claims-paying ability of Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York. For variable annuities, guarantees do not apply to the principal amount or investment performance of a variable annuity’s separate account or its underlying investments. They are not backed by the broker/dealer from which this annuity contract is purchased, by the insurance agency from which this annuity contract is purchased, or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of Jackson National Life Insurance Company or Jackson National Life Insurance Company of New York.

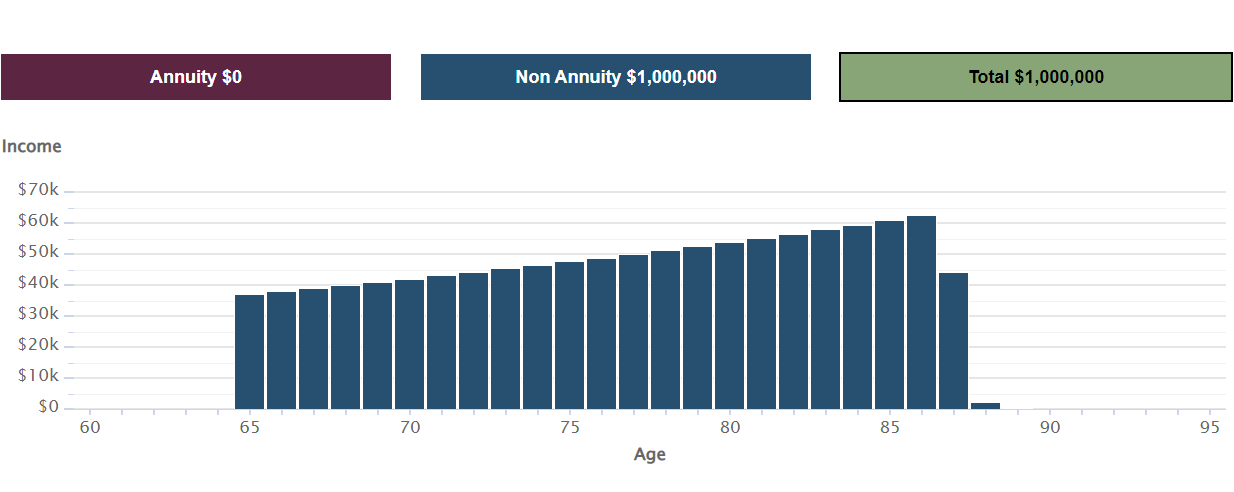

The latest income date or Maturity Date allowed under an annuity contract is the owner’s age 95, which is the required age to annuitize or take a lump sum.

For Variable Annuity Products:

Jackson Retirement Investment Annuity® Variable and Fixed Annuity (contract form numbers VA730, VA730-FB1, ICC20 VA730, ICC20 VA730-FB1) is issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and in New York (contract form numbers VA730NY, VA730NY-FB1) is issued by Jackson National Life Insurance Company of New York (Home Office: Purchase, New York). Annuities are distributed by Jackson National Life Distributors LLC, member FINRA. This contract has limitations and restrictions. Jackson issues other annuities with similar features, benefits, limitations, and charges. Discuss them with your financial professional or contact Jackson for more information.

Jackson +Protect add-on benefit is not available in New York.

Perspective Advisory II® Variable and Fixed Annuity (contract form numbers VA790, VA790-FBI, ICC17 VA790, ICC17 VA790-FB1) is issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and in New York (contract form numbers VA790NY and VA790NY-FB1) by Jackson National Life Insurance Company of New York (Home Office: Purchase, New York). Annuities are distributed by Jackson National Life Distributors LLC, member FINRA. This contract has limitations and restrictions. Jackson issues other annuities with similar features, benefits, limitations, and charges. Discuss them with your financial professional or contact Jackson for more information.

For Fixed Index Annuity Products:

Fixed Index Annuities are also referred to as Fixed Annuities with Index-Linked Interest in the contract.

MarketProtector Advisory® Individual Modified Single Premium Deferred Fixed Annuity With Index-Linked Interest Option and Market Value Adjustment (contract form numbers FIA265, FIA265-FB2, ICC19 FIA265, ICC20 FIA265-FB2) is issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and distributed by Jackson National Life Distributors LLC, member FINRA. This product is a fixed annuity that does not participate in any stock or equity investments and has limitations and restrictions, including market value adjustments (may not be applicable in all states). During the Indexed Option Period the annuity's cash withdrawal value may be less than the initial premium. Additional premium is permitted in the first contract year. For costs and complete details, contact your financial professional or the Company.

All indexes are unmanaged and not available for direct investment. The payment of dividends is not reflected in the index return.

Jackson issues other annuities with similar features, benefits, limitations, and charges. Contact Jackson for more information.

MarketProtector Advisory is not available in California or New York.

Withdrawals may be subject to market value adjustments (MVA) and the Interim Value calculation may apply.

For Registered Index-linked Annuity Products:

This material is authorized for use only when preceded or accompanied by the current contract prospectus. Before investing, investors should carefully consider the investment objectives and risks of the registered index-linked annuity. This and other important information is contained in the current contract prospectus at Jackson.com/ProspectusJMLPA2 for the Jackson Market Link Pro® Advisory II prospectus. Please read the prospectus carefully before investing or sending money.

Jackson Market Link Pro® Advisory II Single Premium Deferred Registered index-linked annuity (contract form numbers RILA295, RILA295-FB1, RILA297, RILA297-FB1) are issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and distributed by Jackson National Life Distributors LLC, member FINRA. May not be available in all states and state variations may apply. These products have limitations and restrictions, including withdrawal charges or market value adjustments. Jackson issues other annuities with similar features, benefits, limitations, and charges. Discuss them with your financial professional or contact Jackson for more information.

Withdrawals may be subject to a market value adjustment (MVA) and the interim value calculation may apply.

Firm and state variations may apply. Additionally, products may not be available in all states.

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company®, and Jackson National Life Insurance Company of New York®.