Emotional spending: Who does it affect most?

Have you ever heard the saying, “Don’t go to the grocery store when you’re hungry”? Be sure to add this next rule to the list: “Don’t go shopping when you’re sad or stressed.”

Emotional spending is a subtle but powerful force in day-to-day finances. From stress-driven late-night clicks to celebratory splurges, emotions often shape how, when and why we buy.

In this article, we'll examine:

- The psychology behind emotional spending

- Who actually spends more: women or men?

- 5 practical strategies to protect your long-term financial plans

Plus, are cultural stereotypes about women and shopping habits true? Let’s look at what the evidence suggests about consumers just like you.

What is emotional spending?

Emotional spending happens when you make a purchase based on momentary feelings rather than need or a plan.

Today’s shopping experience—especially online—amplifies this. You don't even have to go any further than your email inbox to feel the pressure to spend:

"Final hours of our biggest sale of the year!"

"You forgot something in your cart!"

"Treat yourself. You deserve it."

Then, a simple scroll on social media brings instant discount pop-ups, one-click checkout and personalized carousels of ads for skincare, meal kits and outfits you never asked for. An emotional shopper may find it harder to pause between desire and decision, especially when friction is low and rewards feel immediate.

If you’ve been caught up in the cycle of emotional spending, it doesn’t mean you’re “bad with money” or irresponsible. Usually, there’s more going on beneath the surface.

Common triggers for emotional spending include:

- Stress

- Anxiety

- Boredom

- Loneliness or the need for comfort

- Social pressure and comparison

- Special occasions

- Positive emotions like pride, excitement or celebration

This isn't just theory: Studies indicate that emotional, stressful or low-self-esteem-related states can increase impulsive spending.1 And according to a LendingTree survey of 2,000 U.S. consumers, 63% of Americans say they’ve been emotionally influenced while shopping. 74% of those shoppers say it’s led them to overspend.2

4 psychological reasons why we might spend on emotion

So, why are we sometimes prone to stray from our budget and go with our gut instead?

1. Retail "therapy": For many, shopping actually releases dopamine—the happy chemical in your brain that improves your mood or helps you avoid negative emotions.3 Chasing dopamine can unfortunately lead to a vicious cycle of debt.

Example: You and your sister exchanged some words, and now she isn't speaking with you. To help yourself feel better, you buy an expensive, new outfit.

2. Social comparison: Curated lifestyles on social media give the impression that everyone has the means to shop as they please, leading us to want to do the same.4

Example: A friend posts her newly-renovated kitchen on social media, suddenly making your own space feel outdated. You start browsing decor sites and end up buying a new set of bar stools to freshen things up.

3. Compulsion: Susan Albers, PsyD, psychologist for Cleveland Clinic explains, "Compulsive shopping goes hand in hand with emotions and mental health. It's often a way of coping with stress, anxiety, and depression."5 If you feel guilty after spending money, it could signal you're buying out of compulsion and not necessity.

Example: You feel like you deserve a break after a stressful week. Present bias kicks in, and you book a spontaneous vacation you hadn't saved for.

4. Decision fatigue and stress: When overwhelmed, we may default to “easy” choices like impulse buys.6

Example: After a long week of back-to-back decisions, the thought of planning dinner feels impossible. So, you grab overpriced takeout... for the third time this week.

Are any of these examples a little too relatable? Discover practical ways to keep emotional spending in check later in this article.

Emotional spending patterns by life stage and gender

Of course, the way emotional spending catches us at age 22 looks very different than it does at age 42.

It’s especially easy for younger adults to spend on impulse due to social media and seamless checkout. Adults with fluctuating income may rely on emotional spending as a way to cope. Parents may spend emotionally around their children’s needs and milestones. And, as we've previously discussed, those in The Sandwich Generation have more expenses than most.

Our culture has decided that women are the big spenders, so the marketing machine treats them like they already are. But in fact, the data shows that gender barely predicts spending behavior at all.

Do women spend more than men?

The short answer: not consistently. And men are not more likely to be considered "savers" than women.

Insights from Jackson's Spenders and Savers Report reveal that gender does not play a role in Spender/Saver status.7 Whether someone is more disciplined or spontaneous in spending actually reflects mindset, habits and childhood—not gender.

Nature vs. nurture

When you were younger, and got some money for your birthday, did you sock it away for a rainy day? Or did you immediately want to go to the store to spend it?

If you were a saver early on, that was likely influenced by your parents, but not in the way you might expect.

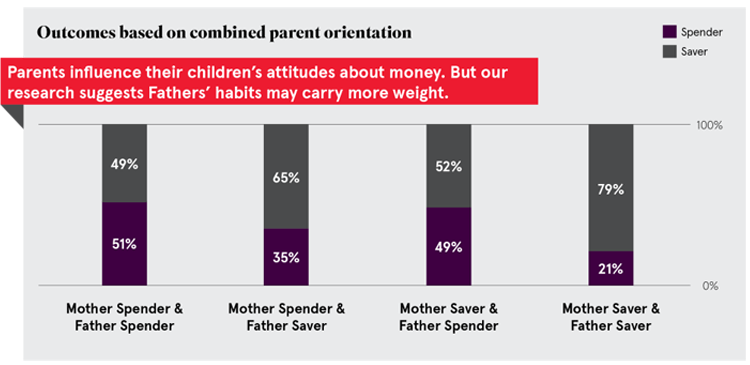

In our Spenders and Savers Report, we found that:8

- When both parents were Spenders, their kids still grew up with roughly a 50% chance of becoming Savers.

- But when the father was a Saver, the chance of the child becoming a Saver jumped to 65%.

- When both mom and dad were Savers, that number rose to nearly 80%.

In other words, your money mindset is inherited or cultivated more than it is gendered. And, for whatever reason, fathers' habits seem to have the strongest influence on their children.

Spending by category

What we buy often reflects responsibilities, identity and the expectations placed on us—which aren’t inherently tied to men or women.

Let’s look at some common spending stereotypes and consider roles and societal expectations.

Women: Apparel, wellness, household items, groceries

Men: Electronics, hobbies, dining, higher-ticket items

What really drives these differences?

Roles and responsibilities: Being the one to make household purchases can be misread as “emotional” when it’s logistical. So, although women appear to buy more household items, it’s often tied to duties—not impulses.9

Cultural pressures: Men may feel the need to signal success through "big-ticket items." An NPR/Marist poll found that men are twice as likely as women to spend more than $1,000 on a single purchase.10 This behavior isn't always about poor financial choices—it can be driven by social stress, which is also one reason women tend to live longer than men.

Marketing messaging: Stereotypes paint women as shopaholics and men as rational savers, but studies don’t actually support this.

How to stop emotional spending

When it comes to building wealth, unplanned purchases can add up and reduce long-term growth potential. A decade of underfunding—even modestly—may substantially shrink your retirement income. Aligning everyday spending with long-range goals helps protect the compounding inside retirement accounts and investments.

1. Create and track your budget

Back to our Savers and Spenders Report, Savers are more likely to track their spending and budget for things they want.11 This may not come as a surprise, but it’s a good reminder that adopting a saver’s mindset starts with setting a budget. Design a budget that anticipates emotions, with a specific category for mood-driven spending (with a reasonable limit).

Bonus tip: Don’t forget to budget for fun goals and milestones, like vacations, new golf clubs, and birthday treats. Budgets don’t confine you; they create capacity for the goals you want to pursue.

2. Automate savings before spending

In his book, The Automatic Millionaire, New York Times bestselling author David Bach presents his one-step system to “finish rich” as so simple it happens while you sleep. Spoiler alert: It’s just a matter of turning on automatic investments and savings transfers, so that it’s out of the way before you can spend it.

3. Use defined spending thresholds for impulse purchases

Create a pause rule and wait 24–48 hours for discretionary buys over a set amount of money. In our Savers and Spenders Report, Savers identified as being more willing to practice delayed gratification.12 This might sound like the least-fun strategy on our list, but it’s a core trait of achieving true financial stability.

4. Schedule regular check-ins to review cash flow, goals and stress-test plans

Creating a clear roadmap with milestones and progress tracking helps plans stay on course, even when emotions run high. If you have questions or just need an accountability partner, schedule a financial review with an experienced financial professional.

5. Recognize your triggers

Notice when and why you spend: time of day, mood, social media habits, etc. Then build in positive friction to create a pause between impulse and purchase. Maybe it’s time to unsubscribe from promotional emails or stop going to the grocery store when you’re hungry.

Frequently asked questions about emotional spending

At Jackson we hope to provide a perspective that empowers families to build financial plans without placing blame. Understanding the realities behind emotional spending can lead to more confident outcomes.

Here are some common questions we hear from Americans:

What are signs that I might be an emotional spender?

Ask yourself if you tend to spend more money when feeling any of these triggers:

- Stress

- Anxiety

- Boredom

- Loneliness or the need for comfort

- Social pressure and comparison

- Special occasions

- Positive emotions like pride, excitement or celebration

If you agree with a couple or several, you might want to get serious about the five strategies we detailed above to stop emotional spending.

Do women spend more than men?

No, not reliably. While spending categories can differ, research does not show a consistent gender skew in total emotional spending. Mindset, childhood and life stage are stronger predictors.

Who spends more money in a relationship?

It varies. One partner may handle household purchases while the other makes fewer—but larger—buys. Differences in earnings and spending visibility also matter. Couples who track jointly and agree on discretionary limits tend to experience fewer conflicts and clearer accountability.

What does a healthy budget look like?

There are many budgeting methods and templates you can try. One popular option for new budgeters is the 50 / 30 / 20 budget. Here’s how to allocate your income based on that system:

- 50% of income to needs

- 30% to wants

- 20% to savings and debt repayment.

This structure can work well for an emotional shopper by adding healthy friction and clarity to day-to-day choices. As always, do your own research or talk to your financial professional to determine the best financial strategy for your unique situation.

With centenarians on the rise and inflation on the rise, the last thing you can afford is letting emotional spending cash out your retirement before you get there.