Building wealth for your retirement

Will you be able to achieve the retirement of your dreams?

It's no secret that saving for retirement and building wealth is important to American investors. In fact, the total US retirement assets were over $45 trillion in the second quarter of 2025.1

And 68% of workers feel confident they will have enough money to live comfortably throughout retirement.2

Are you one of them? You can be! Let’s talk about ways to help build your wealth and how to transfer it and leave a lasting legacy.

Step one to building wealth: eliminate debt

Put simply, debt is the antithesis of building wealth. Unfortunately, debt is a big problem in our country.

In the first half of 2025 alone, credit card debt in the United States soared to an all-time high of $1.21 trillion.3 Those credit card payments (and subsequent interest), month after month, are robbing Americans of money they could be investing for their futures.

Credit card debt is really a double loss:

- You’re losing money to the compounding interest you have to pay (if you carry a balance)

- You’re missing out on the compounding interest you’d gain if your credit card payments were invested in a retirement account instead

Debt takes money out of your pocket rather than making deposits—and at significantly higher rates. Put another way, paying high interest rates on debt could be money invested in your retirement future.

Step two to building wealth: save for the long haul

Beyond debt reduction, make a list of your monthly expenses and create a monthly budget. This starting point will allow you to visualize how much you might be able to save and invest each month.

You might set a specific dollar amount aside, or maybe a percentage. Compounding interest over time is the key here: small amounts invested early can grow into substantial funds later. While it is never too late to start, the earlier you begin, the greater your wealth-building potential.

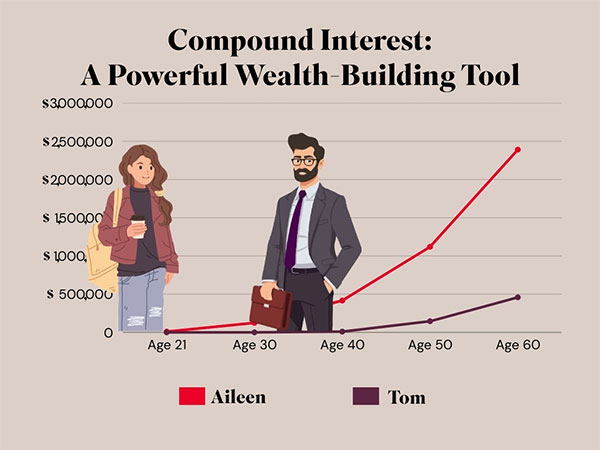

To show the power of compound interest in building wealth, let’s look at a hypothetical example of two people, Aileen and Tom, both age 50 who invest in the market and assume an average annual return of 8%.

- Aileen starts much earlier than Tom. She invests $10,000 per year starting at age 21. By the time she’s 30, she’s already saved about $125,000. By 50, she’s sitting on over a million. And when she retires at 60, her portfolio is worth nearly $2.4 million.

- Tom waits to invest until he’s 40. He also invests $10,000 per year, but since he starts almost two decades later, his results are dramatically different. At 50, Tom’s account is only worth about $145,000. At 60, he ends up with roughly $458,000.

- At age 60, Tom will have less than one-fifth of Aileen’s balance, even though he invested the same amount for twenty years straight. To catch up to Aileen, Tom would have to invest about $52,000 per year from age 40 to 59 to match Aileen’s $2.39M at retirement.

When it comes to building wealth, the biggest advantage is how early you start. Some of the best retirement advice is that the earlier you start investing, the more your money works for you.

When thinking about your strategy, remember that frequent short-term trading can increase risk and expose you to more volatility. Taking a longer-term approach may make it easier to stay focused through market ups and downs instead of reacting to short-term fluctuations.

Real estate as a tool for building wealth

For many people, leasing, renting or having a mortgage will be your largest expense at nearly every stage of your life. Owning your home or accumulating savings toward the goal of owning a home can build wealth into your portfolio because homes have the potential to appreciate in value.

Annuities can help build your wealth

An annuity is a retirement product that may provide protected, reliable income when you need it. It can help bridge the gap between the savings you’ve accumulated over time and traditional sources of retirement income. Plus, if you don’t need the income immediately, you can let it potentially grow tax deferred.* That’s why an annuity may be a powerful addition to your wealth-building plan.

Which annuity option(s) should you consider in your financial plan?

Annuities can be versatile with a variety of options tailored to your retirement plan. When considering an annuity, the process can look like this:

- Decide when you need retirement income: You can invest a lump sum and choose to start receiving payouts immediately or down the road.

- Customize your plan with unique options: Discover how add-on benefits† can help you leave a lasting legacy.

- Choose a product that’s right for you: We offer a variety of annuity products that may fit your specific retirement needs.

Transferring wealth and leaving a legacy

Thinking about how you’ll transfer your wealth and the legacy you’ll leave should be a consideration every step of the way.

Make a list of your assets and create an estate plan to ensure your heirs and beneficiaries are considered and provided for. This step can help reduce costly expenses and taxes, and prevent the stress of an unclear succession plan.

Be sure to re-evaluate your plan periodically. Does it still meet your goals? Does it continue to reflect how you want your hard-earned assets to be distributed? Make sure your estate plan still aligns with your financial intentions.

Get in touch with your financial professional today to learn more about the benefits of annuities from Jackson can help you diversify‡ your financial portfolio and create a lasting wealth strategy.