Annuities explained

November 14, 2025

Empowering financial professionals to educate clients

When it comes to securing a stable financial future, annuities can play a crucial role, especially by providing a reliable stream of income during retirement. But helping your clients understand the different types of annuities and their benefits can be a challenge, to say the least.

This article will help you:

- Explain what an annuity is in a way your clients can understand

- Ask the right questions to determine if an annuity can help support their financial goals

- Cover key considerations they should keep in mind before investing in annuities

- Offer practical examples of how annuities can fit into overall retirement planning

- Help your client make an informed decision about annuity income

Feel free to bookmark or print this article to refer back to before your next meeting. Okay, let's explain annuities...

What is an annuity, in basic terms?

An annuity is a financial product that may provide protected, reliable income when someone needs it—typically during retirement. An annuity can help bridge the gap between their savings accumulated over time, and traditional sources of retirement income: like Social Security. Plus, if they don’t need the income immediately, they can let it potentially grow tax deferred.*

The way it works is through a contract between an individual and an insurance company—like Jackson—where the individual makes a lump sum payment or a series of payments in exchange for regular disbursements over time.

A goal of annuities can be to reduce the risk of outliving one’s savings by ensuring a dependable income source. They can allow retirees to cover essential living expenses while potentially allowing other assets and investment vehicles to grow.

Annuities come in various forms, offering different options to help meet individual needs. While annuities are sometimes viewed as niche products, they can be a meaningful addition to many retirement strategies, no matter the client's financial profile.

Add-on benefits,† available for an extra charge, can also provide protection, guaranteed income for life and legacy options. The long-term advantage of any add-on benefits will vary with the terms of the benefit option, the investment performance of the Variable Investment Options selected, and the length of time the annuity is owned. In some circumstances, the cost of an option may exceed the actual benefit paid under the option.

Types of annuities, explained

Understanding the various types of annuities is crucial for making informed decisions about them. Here are the primary types:

Fixed annuities

Fixed annuities allow investors to avoid market losses and assure a return on their money with a guaranteed interest rate to provide predictable income for a specified term. A fixed annuity could be a good option for someone seeking principal protection and steady growth.

Fixed index annuities

Fixed index annuities blend the security of fixed annuities with the potential for higher returns linked to a stock market index. This means that while your client's contract is protected from market downturns, they can still benefit from a portion of the index's growth, offering a balance of safety and opportunity. Their choice of index determines additional interest that may be credited to their account while maintaining the safety of their principal, as interest is credited based on the performance of an index without being directly invested in the market itself.

Variable annuities

Variable annuities provide a range of investment options, known as subaccounts which are the underlying investment options within the variable annuity including stocks and bonds. This type of annuity provides the potential for higher returns, but it also comes with increased risk, as the value of your client's investment can fluctuate based on market performance. It might be a good option for those comfortable with market risks and seeking growth potential.

Registered index-linked annuities

Registered index-linked annuities (RILAs) let investors pursue market-linked growth with built-in protection features. Their gains are tied to an index and subject to a cap rate, which limits the maximum growth they can earn in each term. Investors can also choose their level of protection: a buffer absorbs a set amount of losses before their principal is affected, while a floor limits how much they can lose if the market drops. RILAs can be a good option for individuals who want growth potential with protection against major losses. Keep in mind, contract fees may apply and losses beyond their protection level can still reduce their principal.

Benefits of annuities

Annuities offer a range of benefits that can be particularly advantageous for retirees and pre-retirees. Here are some key benefits:

Guaranteed income

One of the biggest advantages of an annuity is the guaranteed income it can provide. Your clients can secure a steady stream of payments for life, helping them maintain their standard of living and enjoy retirement with confidence. However, keep in mind that these payments are often fixed for long periods and may not keep pace with inflation, so it's important to plan ahead for rising costs.

Protection against market volatility

Another key benefit is protection against market volatility. Unlike many investment options that fluctuate with market conditions, certain types of annuities can offer a predictable stream of income. This feature is especially appealing during economic downturns when people may worry about their retirement savings diminishing due to market swings.

Tax-deferred growth

Annuities come with tax-deferred growth potential. This means that your client's investment can grow without being taxed until they start receiving payments. This tax advantage allows their money to compound more efficiently, enhancing their overall retirement savings.

Customization options

Lastly, annuities provide customization options and add-on benefits tailored to different needs. Whether your clients want to provide a death benefit for their beneficiaries or add features that support their broader retirement goals, there are various riders and features that can be integrated into an annuity. This flexibility can help them create a financial product that aligns with their retirement goals and estate plan.

Considerations before investing in annuities

Before diving into the world of annuities, it’s crucial to understand the various considerations that can impact an investment. Here are some primary factors to consider:

Fees and charges

Annuities come with various fees and charges, such as surrender charges, administrative fees and mortality and expense risk charges. It’s essential to thoroughly review these costs as they can affect overall returns and the value of an investment over time.

Liquidity

Another important aspect is liquidity. Annuities are typically designed for long-term investment, which means that accessing money before the agreed-upon period can lead to substantial surrender charges. These charges are fees imposed when funds are withdrawn from the annuity prematurely, often resulting in a percentage of the investment being deducted. Understanding the terms related to liquidity will help investors avoid unexpected penalties and ensure they have access to their funds when they need them.

Risk factors and market conditions

Portfolio risk is a concern with any annuity product. Be sure to consider the risk factors and market conditions that may influence your client's annuity choice. While some annuities offer a guaranteed return, others may be linked to market performance, which introduces a level of risk. Economic fluctuations can impact the performance of an annuity, so it’s vital to stay informed about market trends and assess their risk tolerance before making a decision.

By taking these considerations into account, you can help them make a more informed choice regarding annuities and align it with their financial goals.

Practical example of annuities

When considering annuities, it can be helpful for investors to visualize their sources of retirement income as a series of buckets or pieces of a pie—each representing a different aspect of their financial goals. These examples can make it easier to understand how annuities can fit into their overall retirement strategy:

Both of these examples can help start a conversation with your clients about a balanced approach to financial planning. And be sure to take advantage of our other tools, calculators and resources to help them plan a confident retirement.

The bucket example:

Imagine this as a hypothetical framework where each bucket represents a different potential source of income or benefit. For example, one bucket might be earmarked for lifetime income, helping manage the risk of outliving savings. Another could be positioned to support loved ones financially in the future. A third might represent more liquid, cash-on-hand reserves.

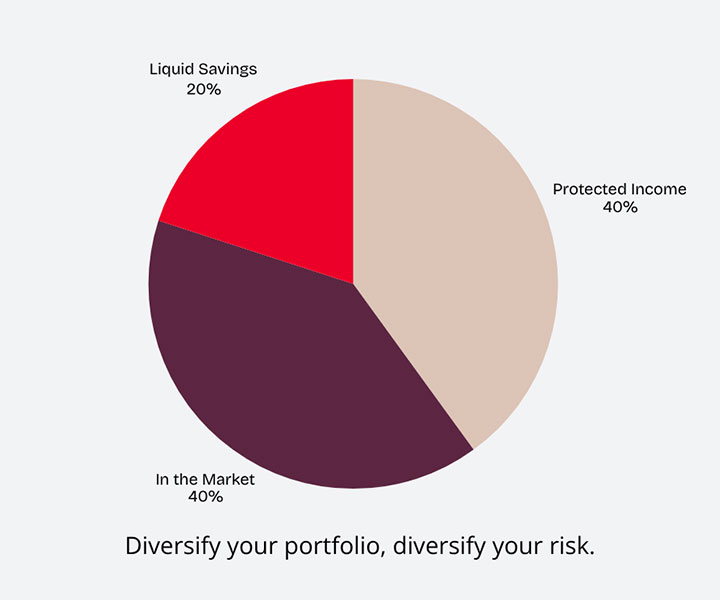

The pie example:

Similarly, think of the pie slices as a hypothetical way to divvy up different investment options in a portfolio. Each slice could represent varying levels of risk, return and liquidity—helping illustrate how clients might structure their savings. This is just one potential approach: for example, someone might choose to allocate a larger slice to a fixed annuity for stability, while reserving a smaller slice for investments tied to market growth. The right mix will always depend on individual goals, comfort with risk and personal financial circumstances.

Article library

Dig into our best reads that could aid your next client conversation or where to take your business next.

*Tax deferral offers no additional value if an IRA or a qualified plan, such as 401(k), is used to fund an annuity and may be found at lower cost in other investment products. It also may not be available if the annuity is owned by a legal entity such as a corporation or certain types of trusts.

†Add-on benefits that provide income for the length of a designated life and/or lives may be available for an additional charge. The amount of income that these benefits may provide can vary depending on the age when income is taken, and how many lives are covered when the benefit is elected. The cost of these benefits may negatively impact the contract's cash value.

Annuities are long-term, tax-deferred vehicles designed for retirement and are insurance contracts. Variable annuities and registered index-linked annuities involve investment risks and may lose value. Earnings are taxable as ordinary income when distributed. Individuals may be subject to a 10% additional tax for withdrawals before age 59½ unless an exception to the tax is met. Add-on living benefits are available for an extra charge in addition to the ongoing fees and expenses of the variable annuity and may be subject to conditions and limitations. There is no guarantee that an annuity with an add-on living benefit will provide sufficient supplemental retirement income.

Jackson, its distributors, and their respective representatives do not provide tax, accounting, or legal advice. Any tax statements contained herein were not intended or written to be used and cannot be used for the purpose of avoiding U.S. federal, state, or local tax penalties. Tax laws are complicated and subject to change. Tax results may depend on each taxpayer’s individual set of facts and circumstances. Clients should rely on their own independent advisors as to any tax, accounting, or legal statements made herein.

Guarantees are backed by the claims-paying ability of the issuing insurance company.

Annuities are issued by Jackson National Life Insurance Company (Home Office: Lansing, Michigan) and in New York by Jackson National Life Insurance Company of New York (Home Office: Purchase, New York). Variable annuities and registered index-linked annuities are distributed by Jackson National Life Distributors LLC, member FINRA. These products have limitations and restrictions. Discuss them with your clients or contact Jackson for more information.

Jackson® is the marketing name for Jackson Financial Inc., Jackson National Life Insurance Company®, and Jackson National Life Insurance Company of New York®.