IMPORTANT: The outcomes displayed in the Proposed Gap Solution are hypothetical in nature, do not reflect an individual's actual investment results and are not a guarantee of future results. This tool is for illustrative purposes only and is not representative of the past or future performance of any Jackson product. Results may vary with each use and over time.

The outcomes presented by the Proposed Gap Solution are provided for informational purposes and are not intended as investment advice or a recommendation. Your clients’ individual circumstances may vary. Your clients should consider their individual situation, including time horizon, risk tolerance, investment objectives and the need for an annuity before investing.

The Proposed Gap Solution is designed to calculate the investment amount needed today to purchase a variable annuity with an add-on living benefit to cover the estimated Income Gap in the first year of retirement and continue that income payment through the lifetime of the retiree. This calculation is done independently by Hedgeness Inc. by using its data-driven and objective software called Guaranteed Retirement Analytics for Income and Legacy (GRAIL).

The withdrawal assumptions rate for this tool is age 65. The actual rate could be lower or higher depending on the age at the time of withdrawal.

Methodology:

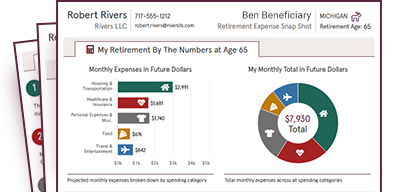

GRAIL determines the number of years until start of retirement using the desired retirement age minus current age entered in the Retirement Expense & Income Calculator.

Using the number of years until start of retirement along with the inputs of:

- Retirement Expense & Income Calculator

- Current age

- Retirement age

- Current salary

- Current state

- Retirement state

- Monthly expenses

- Guaranteed income amounts

- Estimated Income Gap dollar amount

- Risk Profile / asset allocation (choose one)

- Conservative allocation of 25 % Stocks, 60% Bonds and 15% Cash

- Moderate allocation of 50% Stocks, 45% Bonds and 5% Cash

- Aggressive allocation of 80% Stocks and 20% Bonds

- Assumptions of a variable annuity with an add-on living benefit

GRAIL runs multiple historical iterations to arrive at an array of possible Proposed Gap Solution numbers and then calculates an output based on the median. Changing any of the inputs will result in a different output.

By using historical returns based on Shiller data of stocks (S&P 500 Index), bonds (10 year US Treasury), and cash (1 year US Treasury) dating back to 1871, GRAIL analyses incorporate many variables ranging from different sequence of returns to different market volatility, and calculate the multi-faceted effects of the same on the assumed variable annuity and add-on living benefit features.

Since all analyses are based on historical performance and what-if scenarios, the possible statistical relevance remains at the level of estimates that might substantially differ from future results.

To emphasize the hypothetical nature of these analyses, GRAIL also provides a second Proposed Gap Solution investment amount that is based on 0% returns of stocks, bonds, and cash through all the iterations. In the context of what-if scenarios, you can view this as the “worst case” scenario, because this number represents the maximum investment amount needed to invest today to meet the estimated Income Gap.

Important Information about Hedgeness:

Hedgeness Inc. (the “Company”) produces ratings, research, and reports (collectively the “Analytics”). The Company uses proprietary software to conduct the Analytics, and this disclosure is applicable to the software and its configurations.

The information produced by the Analytics regarding the possibility of varying investment outcomes are hypothetical, do not reflect actual investment performance, and are not promises of future performance. The results may differ over time.

There is no implicit or explicit guarantee that an investment approach based on the Analytics will be effective. The results shown are for informational purposes only.

The Company does not provide any guarantee or accept any liability related to quality or accurateness of data used in the Analytics and does not promise that the results of the Analytics will not diverge from their specified methodologies. The Company does not provide any guarantee for Company errors, both in regard to data and calculations thereof.

The information in Analytics should not be construed as investment advice, or a recommendation by the Company regarding the use or appropriateness of the findings. Investors should consult their financial professional to assess their investment goals. Investing involves risk, including potential loss of principal.

The Company is a software company and not authorized to sell any security or investment advice.

All names of indices, insurance carriers, asset managers, and products used in the Analytics are the property of their respective owners, and not those of Hedgeness, Inc.

In summary, the Analytics do not constitute investment advice offered by the Company; are provided solely for informational purposes; do not constitute an offer to buy or sell a security; and are not warranted to be correct, complete or accurate.

Jackson and Hedgeness are separate entities.